ECON 616: Machine Learning

Intro + Defintions

Background

- Stuff written by economists: Varian (2014),

Mullainathan and Spiess (2017), Athey (2018)

- Useful books: Hastie, Tibshirani, and Friedman (2009),

- Gentle introduction: Machine Learning on http://coursera.org;

many other things on the internet (of varying quality).

- Computation:

scikit-learn(python).

“Machine Learning” definition

Hard to define; context dependent;

… a field that develops algorithms designed to applied to datasets with the main areas of focus being prediction (regression), classification, and clustering or grouping tasks.

Broadly speaking, two branches:

- Supervised: dependent variables known (think predicting output growth)

- Unsupervised: dependent variables unknown (think classifying recessions)

A Dictionary

| Econometrics | ML | |

|---|---|---|

| \(\underbrace{y}_{T\times 1} = \{y_{1:T}\}\) | Endogenous | outcome |

| \(\underbrace{X}_{T\times n} = \{x_{1:T}\}\) | Exogenous | Feature |

| \(1:T\) | “in sample” | “training” |

| \(T:T+V \) | ??? not enough data! | “validation” |

| \(T+V:T+V+O\) | “out of sample” | “testing” |

Today I’ll concentrate on prediction (regression) problems.

\[

\hat y = f(X;\theta)

\]

Economists would call this modeling the conditional expectation,

MLers the hypothesis function.

It all starts with a loss funciton

Generally speaking, we can write (any) estimation problem as

essentially a loss minizimation problem.

Let \(L\)

\[

L(\hat y, y) = L(f(X;\theta), y)

\]

Be a loss function (sometimes called a “cost” function).

Estimation in ML: pick \(\theta\) to minimize loss.

ML more concerned with minimizing my loss than inference on

\(\theta\) per se.

Forget standard errors…

Gradient Descent

- In practice, it is often not possible to minimize the loss

function analytically.

- In fact, most machine learning models correspond to functions

\(f(\cdot;\theta)\) that are highly nonlinear in \(\theta\).

- In addition to an explosition of datasets, a large part of the

success of machine learning algorithms is the development of

robust minimization routines.

- The first one everyone learns is called

gradient descent: \[ \theta ’ = \theta + \alpha \frac{d L(\hat y,y)}{d \theta} \] - You can use this for OLS when \(N > T\).

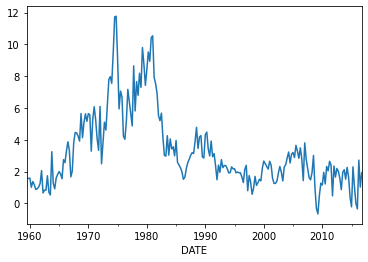

Example: Forecasting Inflation

Let’s consider forecasting (GDP deflator) inflation.

Linear Regression

- Consider forecasting inflation using only it’s lag and constant.

- Training sample: 1985-2000

- Testing sample: 2001-2015

- scikit-learn code

from sklearn.linear_model import LinearRegression

linear_model_univariate = LinearRegression()

train_start, train_end = '1985', '2000'

inf['inf_L1'] = inf.GDPDEF.shift(1)

inf = inf.dropna(how='any')

inftrain = inf[train_start:train_end]

Xtrain,ytrain = (inftrain.inf_L1.values.reshape(-1,1),

inftrain.inf)

fitted_ols = linear_model_univariate.fit(Xtrain,ytrain)

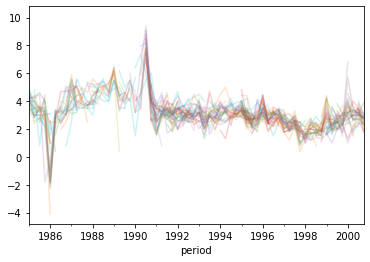

Many regressors

Let’s add the individual spf forecasts to our regression.

/home/eherbst/miniconda3/lib/python3.8/site-packages/openpyxl/worksheet/header_footer.py:48: UserWarning: Cannot parse header or footer so it will be ignored

warn("""Cannot parse header or footer so it will be ignored""")

Estimating this in scikit learn is easy

spf_flatted_zero = spf_flat.fillna(0.)

spfX = spf_flatted_zero[train_forecasters][train_start:train_end]

spfXtrain = np.c_[Xtrain, spfX]

linear_model_spf = LinearRegression()

fitted_ols_spf = linear_model_spf.fit(spfXtrain,ytrain)

| Train | Test | |

|---|---|---|

| LS-univariate | 0.59 | 2.28 |

| LS-SPF | 0 | 2.1 |

Regularization

We’ve got way too many variables – our model does horrible out of

sample!

Their are many regularization techniques available for variable selection

Conventional: AIC, BIC

Alternative approach: Penalized regression.

Consider the loss function:

\[

L(\hat y,y) = \frac{1}{2T} \sum_{t=1}^T (f(x_t;\theta) - y)^2 +

\lambda \sum_{i=1}^N \left[(1-\alpha)|\theta_i| + \alpha|\theta_i|^2\right].

\]

This is called elastic net regression. When \(\lambda = 0\), we’re back to OLS.

Many special cases.

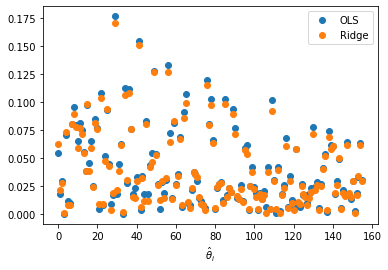

Ridge Regression

The ridge regression Hoerl and Kennard (2004) is special case where \(\alpha

= 1\).

Long (1940s) used in statistics and econometrics.

This is sometimes called (or is a special case of) “Tikhonov regularization”

It’s an L2 penalty, so it’s won’t force parameters to be exactly

zero.

Can be formulatd as Bayesian linear regression.

from sklearn.linear_model import Ridge

fitted_ridge = Ridge().fit(spfXtrain,ytrain)

LS vs Ridge (\(\lambda = 1\)) Coefficients

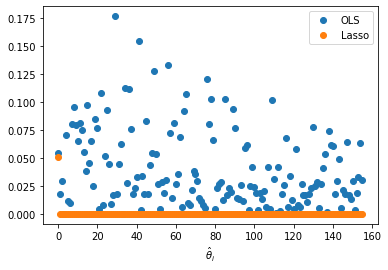

Lasso Regression

Set \(\alpha = 0\)

- This is an \(L1\) penalty – forces small coefficients to exactly 0.

- Greatly reduces model complexity.

- Can you give economic interpretation to the parameters?

- Bayesian interpetation: Laplace prior in \(\theta\).

from sklearn.linear_model import Lasso

fitted_lasso = Lasso().fit(spfXtrain,ytrain)

LS vs Lasso (\(\lambda = 1\)) Coefficients

Picking \(\lambda\)

Use “rule of thumb” given subject matter.

Tradition validation: Use many \(\lambda\) on your test sample, Assess accuracy of each on validation sample, pick one which gives minimum loss.

Cross validation:

- Divide sample in \(K\) parts:

- For each \(k \in K\), pick \(\lambda_k\), fit model using the \(K-k\) sample.

- Plot Loss against \(\lambda_k\), pick \(\lambda\) which yields minimum.

Chernozhukov et al. (2018) derive “Oracle” properties for LASSO, pick \(\lambda\) based on this.

| Method | Train | Train |

|---|---|---|

| Least Squares (Univariate) | 0.35 | 0.71 |

| Least Squares (SPF) | 0.0 | 0.68 |

| Least Squares (SPF-Ridge) | 0.0003 | 0.67 |

| Least Squares (SPF-Lasso) | 0.59 | 0.96 |

Support Vector Machines

Support Vector Machines

- While Elastic net, lasso, and ridge were designed around regularization, other machine learning techniques are designed to fit more flexible models.

- Support Vector Machines are typically used in classification

problems.

- Essentially SVM constructs a seperating hyperplane (hello 2nd

basic welfare theorem), to optimally seperate (“classify”)

points.

- What’s cool about the support vector machine is that you can use

a kernel trick, so your hyperplanes need not correspond to lines

in euclidean space.

- For regression, the hyperplane will be prediction.

Support Vector Machines

- Explicit form: \[ f(x;\theta) = \sum_{i=1}^n \theta_i h(x) + \theta_0. \]

- \(\epsilon\) insensitive loss: function does not penalize

predictions which are in an \(\epsilon\) of the, otherwise the

penalized by a factor relatid to \(C\) (comes from dual problem).

- Key choice here: the choice of kernel

- \(\epsilon\), \(C\) chosen by (cross) validation.

Estimating Support Vector Machine

from sklearn.svm import SVR

fitted_svm = SVR().fit(Xtrain,ytrain)

| Method | Train | Train |

|---|---|---|

| Least Squares (Univariate) | 0.35 | 0.71 |

| Least Squares (SVM) | 0.06 | 0.73 |

Other ML Techniques

Other Popular ML Techniques

Forests: partition feature space, fit individual models condition on subsample.

Obviously, you can partition ad infinitum to obtain perfect predictions.

Random forest: pick random subspace/set; average over these random models.

Long literature in econometrics about model averaging Bates and Granger (1969).

Further refinements: bagging, boosting.

Neural Networks

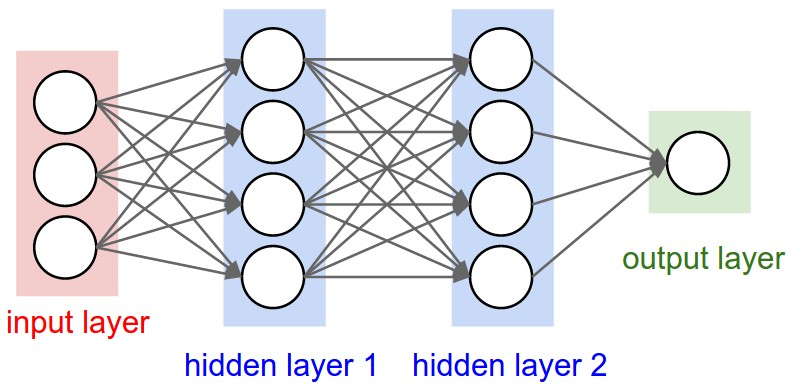

Neural Networks

Let’s construct a hypothesis function using a neural network.

Suppose that we have \(N\) features in \(x_t\).

(Let \(x_{0,t}\) be the intercept.)

Neural Networks are modeled after the way neurons work in a brain as basical

computational units.

- Inputs (dendrites) channeled to outputs (axons)

- Here the input is \(x_t\) and the output is \(f(x_t;\theta)\).

- The neuron maps the inputs to outputs using a (nonlinear) activation function \(\(g\)\).

- By adding layers of neurons, we can create very (arbitrary) complex prediction models (all “logical gates”).

Neural Networks, continued

Drop the \(t\) subscript. Consider: \[ \left[\begin{array}{c} x_{0} \\ \vdots \\ x_{N} \end{array}\right] \rightarrow [~] \rightarrow f(x;\theta) \] \(a_i^j\) activation of unit \(i\) in layer \(j\).

\(\beta^j\) matrix of weights controlling function mapping layer \(j\) to layer \(j+1\). \[ \left[\begin{array}{c} x_{0} \\ \vdots \\ x_{N} \end{array}\right] \rightarrow \left[\begin{array}{c} a_{0}^2 \\ \vdots \\ a_{N}^2 \end{array}\right] \rightarrow f(x;\theta) \].

Neural Networks in a figure

Neural Networks Continued

If \(N = 2\) and our neural network has \(1\) hidden layer.

\begin{eqnarray} a_1^2 &=& g(\theta_{10}^1 x_0 + \theta_{11}^1 x_1 + \theta_{12}^1 x_2) \nonumber \\ a_2^2 &=& g(\theta_{20}^1 x_0 + \theta_{21}^1 x_1 + \theta_{22}^1 x_2) \nonumber \\ f(x;\theta) &=& g(\theta_{10}^2 a_0^2 + \theta_{11}^2 a_1^2 + \theta_{12}^2 a_2^2 \\ \end{eqnarray}

(\(a_0^j\) is always a constant (“bias”) by convention.)

Matrix of coefficients \(\theta^j\) sometimes called weights

Depending on \(g\), \(f\) is highly nonlinear in \(x\)! Good and bad …

Which activation function?

| name | |

|---|---|

| linear | \(\theta x\) |

| sigmoid | \(1/(1+e^{-\theta x}\) |

| tanh | \(tanh(\theta x)\) |

| rectified linear unit | \(max(0,\theta x)\) |

| … | … |

How to pick \(g\)…?

- Dependent on problem: prediction vs classification.

- Think about derivate of cost/loss wrt deep parameters.

- Trial and error

How to estimate this model.

Just like any other ML model: minimize the loss!

Gradient descent needs a derivative

back propagation algorithm

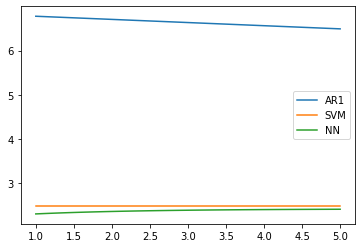

Application: Nakamura (2005)

- Nakamura (2005) considers (GDP deflator) inflation forecasting

with a neural network.

- Model has 1 hidden layer, and uses a hyperbolic tangent

activation function

- Can be explicitly written as:

\[

\hat\pi_{t+h} = w_{2,1}\tanh(w_{1,1}’ x_{t} + b_{1,1}) + w_{2,2}\tanh(w_{1,2}'

x_{t} + b_{1,2}) + b_{2,1}

\]

- \(x_{t}\) is a vector of \(t-1\) variables. For simplicity, I’ll consider \(x_{t-1} = \pi_{t-1}\).

scikit-learn code

from sklearn.neural_network import MLPRegressor

NN = MLPRegressor(hidden_layer_sizes=(2,),

activation='tanh',

alpha=1e-6,

max_iter=10000,

solver='lbfgs')

fitted_NN = NN.fit(Xtrain,ytrain)

Neural Network vs. AR(1): Predicted Values

What is the “right” method to use

You might have guessed…

Wolpert and Macready (1997): A universal learning algorithm does cannot exist.

Need prior knowledge about problem…

This is has been present in econometrics for a very long time…

There’s no free lunch!.